Thinking about getting pregnant this year?

Make sure your insurance plan lines up with your goals during Open Enrollment season.

It’s open enrollment season, a time when many Americans insured through an employer or on government exchanges sign up for a health plan for the upcoming year. In most states, federal open enrollment runs through December 15, 2019, though you may have more time if you live in one of twelve states and the District of Columbia that run their own exchanges.

If you are thinking about getting pregnant this coming year, now is a great time to evaluate your insurance coverage to make sure your plan covers services you might need! Below are five quick tips for evaluating your coverage during open enrollment season:

1. You might not be able to switch plans mid-year, so find a plan that covers what you need now.

Becoming pregnant is not typically considered a “qualifying life event” that lets you change or enroll in coverage mid-year. So, it’s important to look at your coverage details now, during open enrollment, so you can switch plans if you need to.

2. Check the specific benefits your plan offers.

Though all marketplace plans cover pregnancy and childbirth as essential health benefits, plans differ in terms of costs and specific covered benefits. Specific services might not be included in every plan, and some plans have limits, caps, or specific requirements around these services. If you are aware of any complicating factors that may impact your pregnancy, or plan to deliver outside of a hospital setting – like nearly 60,000 women every year – you may want to assess the copayments, limits, and requirements associated with those services. With a little digging, you can understand coverage up front and make sure it meets your needs. Services to look out for include:

- Fertility services

- Pregnancy-related counseling

- Midwifery services

- Ultrasounds

- Anesthesia and pain management services

- Unplanned obstetrical surgery or extended stays in the maternity ward

- Labor and delivery services outside of a hospital setting

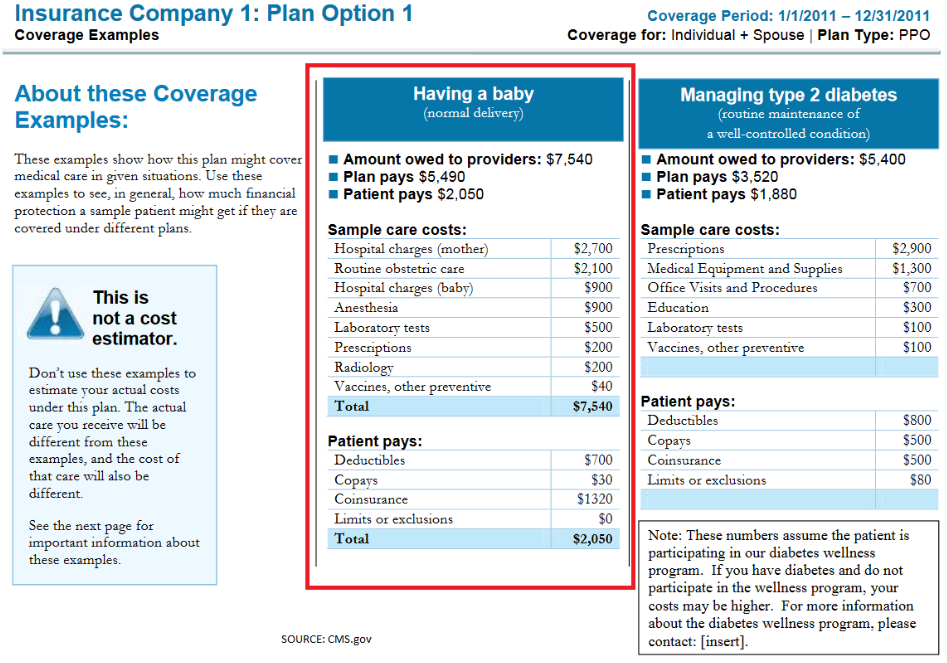

3. Compare example cost estimates for delivering your baby.

According to data available through Fair Health, the average price of having a baby, through vaginal delivery, is between $5,000-$11,000. For a C-section, average costs are from $7,500-$14,500. The exact cost can vary widely, and what your insurance covers can have a big impact on what costs you end up needing to pay out of pocket.

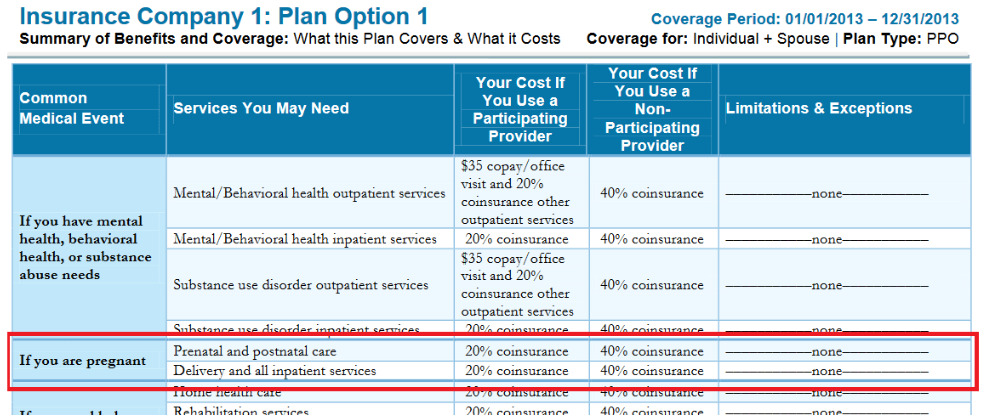

Comparing maternity costs across plans is easier than you might think. Pregnancy and giving birth are among the “common medical events” that insurers must spell out in detail in any plan’s Summary of Benefits and Coverage document. While the estimates provided are not going to exactly line up with your costs – they provide a good example of what percent of the costs you might be responsible for and can show you which plans might end up costing less. The example below shows a Summary of Benefits and Coverage document and highlights what pregnancy information is covered there.

To maximize your insurance benefits, check to make sure that your preferred doctors and medical facilities are in-network in each of the plans you are considering. Using in-network providers will always cost less out of pocket. Beyond your regular OB-GYN or midwife, look at hospitals and specific providers within hospitals – like anesthesiologists if you plan to use an epidural. Knowing more about your network can save you from the shock of surprise medical bills from providers that don’t participate in your plan.

5. Consider tax-advantaged accounts.

Knowing that pregnancy can be expensive, you can also look into whether a tax-advantaged account can help you plan for and reduce costs. Depending on your insurance, you might be able to leverage a health savings account (HSA), a medical flexible spending account (FSA), or both. Each of these accounts has different contribution limits and rules that help you use tax-free funds to pay for medical expenses. You may want to include these types of accounts in your health insurance strategy.

Choosing to begin your journey toward pregnancy is a big deal and an exciting life event. One important step is to make sure you have the insurance coverage you need to get started. Advantia Health is here to support you every step of the way by providing compassionate, comprehensive care that meets your needs. We understand that health plans like we’ve described above can lead to more patient responsibility. Our practices will work directly with our patients on payment options that can make the process easier.